Market Overview: China's EV Revolution

China's electric vehicle (EV) market has rapidly grown into the world's largest, with over 11 million units sold in 2024—nearly half of all new cars sold that year. While growth moderated in mid-2025 due to price competition and slowing plug-in hybrid demand, China continues to lead globally in EV adoption, exports, and innovation. Dominant players such as BYD and Tesla showcase the country's competitive edge, supported by strong government policies, subsidies, tax incentives, and major investments in charging infrastructure and battery technology. This analysis explores the performance of leading manufacturers and the broader dynamics shaping China's EV industry.

User Objectives Addressed:

- Investment decision-making: Provide insights to guide investors evaluating opportunities and risks in Chinese EV stocks.

- Competitive analysis: Support industry professionals in understanding brand positioning, market share shifts, and strategic responses.

- Market trend analysis: Offer researchers and policymakers data on growth patterns, policy impacts, and future adoption trajectories.

- Consumer awareness: Highlight leading EV brands and models shaping choices in China's automotive landscape.

Global EV Sales Market Explore→

Global EV adoption has accelerated over the past decade, with China, Europe, and the U.S. leading the charge. The table below highlights regional sales growth from 2018 to 2024, showing how each market has contributed to the industry's rapid expansion.

| Region | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|

| CN OEM | 0.60M | 0.80M | 1.20M | 3.00M | 5.50M | 7.50M | 9.00M |

| EU OEM | 0.60M | 0.80M | 1.00M | 1.20M | 2.20M | 2.40M | 3.00M |

| US OEM | 0.20M | 0.25M | 0.35M | 0.80M | 1.50M | 2.00M | 2.50M |

| JP OEM | 0.08M | 0.10M | 0.15M | 0.25M | 0.35M | 0.40M | 0.45M |

| KR OEM | 0.08M | 0.10M | 0.15M | 0.25M | 0.35M | 0.40M | 0.45M |

China Monthly BEV and PHEV Sales

China surpassed 1 million monthly EV sales for the first time in August 2024, with a total of 1,027,083 units. The breakdown shows the growing importance of both BEV and PHEV technologies in the Chinese market.

| Month | BEV Sales | PHEV Sales | Total NEV Sales | BEV Share (%) | PHEV Share (%) |

|---|---|---|---|---|---|

| Jan 2023 | 220,000 | 120,000 | 340,000 | 64.7% | 35.3% |

| Jun 2023 | 450,000 | 200,000 | 650,000 | 69.2% | 30.8% |

| Dec 2023 | 580,000 | 360,000 | 940,000 | 61.7% | 38.3% |

| Jan 2024 | 370,000 | 280,000 | 650,000 | 56.9% | 43.1% |

| Jun 2024 | 510,000 | 340,000 | 850,000 | 60.0% | 40.0% |

| Aug 2024 | 582,813 | 444,270 | 1,027,083 | 56.8% | 43.2% |

China EV Sales Market Explore→

China remains the core driver of global EV growth, with domestic brands and international players competing for market share. The table below compares sales performance across major manufacturers, offering insights into market leaders, trends, and emerging challengers.

| Brand | January 2025 Sales | November 2024 Sales | Monthly Change (%) | 2024 YTD Total | Market Position | Vehicle Type Focus |

|---|---|---|---|---|---|---|

| BYD | 296,446 | 504,003 | -42% | 3,718,281 | Market Leader | BEV + PHEV |

| Geely | 121,071 | 122,453 | -1% | 862,933 | Premium Tier | Mixed Portfolio |

| Tesla | 88,321 | 82,927 | +6% | 657,102 | Premium BEV | Pure BEV |

| SAIC-GM-Wuling | 42,500 | 48,200 | -12% | 647,047 | Mass Market | Mini EV |

| Chery | 38,900 | 41,200 | -6% | 520,000 | Traditional OEM | Mixed Portfolio |

| Li Auto | 25,400 | 48,740 | -48% | 500,508 | Extended Range | EREV Focus |

| SAIC Passenger Vehicle | 32,100 | 35,800 | -10% | 485,000 | Traditional + EV | Mixed Portfolio |

| Changan | 35,200 | 38,900 | -10% | 450,000 | Traditional OEM | Mixed Portfolio |

| GAC Aion | 28,800 | 32,150 | -10% | 370,000 | Premium EV | Pure BEV |

| Leapmotor | 22,500 | 25,400 | -11% | 280,000 | Smart EV | Pure BEV |

| Ideal (Li Auto Legacy) | 18,900 | 21,200 | -11% | 248,000 | Premium EREV | Extended Range |

| Xpeng | 30,350 | 30,895 | -2% | 190,500 | Smart EV | Pure BEV |

| NIO | 13,863 | 15,493 | -11% | 190,832 | Premium Service | Battery Swap |

| Xiaomi | 28,500 | 22,050 | +29% | 185,000 | New Entrant | Smart BEV |

| Zeekr | 12,800 | 18,200 | -30% | 165,000 | Luxury EV | Premium BEV |

| Deep Blue | 15,200 | 17,800 | -15% | 158,000 | Changan Premium | BEV + EREV |

| Avatr | 8,500 | 9,200 | -8% | 125,000 | Emerging | Premium BEV |

| Hongqi | 11,200 | 12,800 | -12% | 118,000 | Luxury Brand | Mixed Portfolio |

| Lynk & Co | 9,800 | 11,400 | -14% | 112,000 | Geely Premium | Mixed Portfolio |

| AITO (Huawei) | 8,200 | 10,600 | -23% | 108,000 | Smart Premium | EREV + BEV |

| Volkswagen ID | 6,200 | 8,500 | -27% | 95,000 | International | Pure BEV |

| JAC | 7,500 | 8,900 | -16% | 88,000 | Commercial + EV | Mixed Portfolio |

| BYD Yangwang | 5,800 | 6,200 | -6% | 72,000 | Ultra-Luxury | Premium BEV |

| Geometry | 4,200 | 5,100 | -18% | 65,000 | Geely EV | Pure BEV |

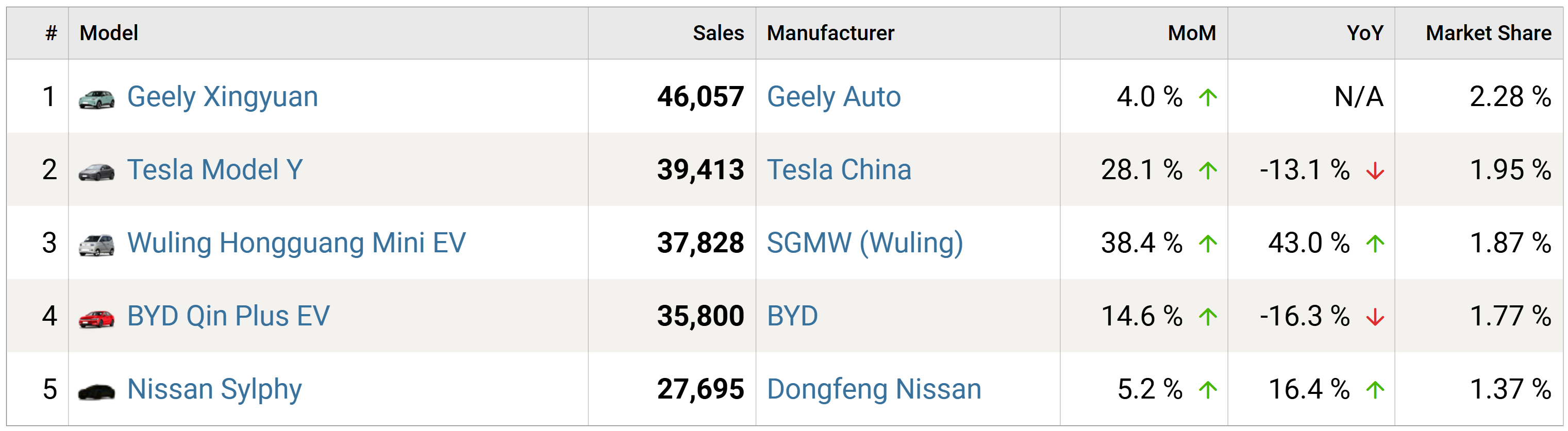

Model Domestic Sales Leaderboard Explore→

Individual EV model performance highlights market preferences and competitive dynamics, revealing which models drive brand success in China's EV landscape.

Market Leader Analysis: BYD Dominance

| Metric | BYD Performance |

|---|---|

| 2024 Total Sales | 4.3 Million Units |

| Market Share | 31.4% |

| Vehicle Types | BEV + PHEV |

Analysis: BYD maintains commanding market leadership despite a 42% January decline, typical of post-holiday seasonality. The company's dual-technology approach (BEV and PHEV) provides flexibility across different consumer segments and government incentive structures.

Furthermore, compared with competitors like Geely, Tesla, and Li Auto, BYD leads in total sales and market share. While Tesla grows steadily in the premium BEV segment, BYD’s diverse BEV and PHEV lineup captures a larger market. Emerging players like Xiaomi and established brands such as SAIC-GM-Wuling lag behind, underscoring BYD’s scale, strong brand, and balance of innovation, affordability, and production capacity.

Growth vs. Decline Patterns

Growth Winners:

- Xiaomi: +29% (New market entrant gaining traction)

- Tesla: +6% (Stable premium positioning)

Seasonal Declines:

- Zeekr: -30% (Premium segment most affected)

- Li Auto: -48% (International brand challenges)

- BYD: -42% (Market leader seasonal adjustment)

Key Insight: January's seasonal slowdown shows how new entrants like Xiaomi are gaining momentum, while leaders such as Tesla and BYD stay steady. In contrast, premium and international brands like Zeekr and Li Auto are hit harder, reflecting rising competition and changing consumer choices.

EV Industry Glossary

- BEV (Battery Electric Vehicle)

- Fully electric cars that run only on batteries—no gas engine at all. These are the main drivers of China's EV boom, like Tesla Model 3 and BYD Han EV.

- PHEV (Plug-in Hybrid Electric Vehicle)

- Cars that have both a battery and a gas engine. You can charge them like an electric car, but they also switch to gas when the battery runs low. Think of it as a flexible option for longer trips.

- EREV (Extended Range Electric Vehicle)

- An electric vehicle that uses a small, onboard internal combustion engine (ICE) to act as a generator, charging the battery when it runs low and allowing for a longer total driving range without the need for a full charge. The key difference from other hybrids is that the engine in an EREV never directly drives the wheels; it only produces electricity to power the electric motor.

- EV Penetration Rate

- This tells you how much of the new car market is electric. For example, in 2024, a quarter of all new cars in China were EVs—pretty massive for one market.

- Battery Swapping

- A technology for electric vehicles (EVs) where a driver exchanges a depleted battery for a fully charged one at a specialized station in minutes, rather than waiting to recharge it.

- YTD (Year-to-Date)

- This is just a running total from the start of the year. So when we say BYD sold 3.7 million cars YTD, that's everything from January to now.